TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems you’ve seen in your practice. This tool lets your tax professional submit an authorization request to access your individual taxpayer IRS online account. Go to IRS.gov/Forms to view, contingent liability definition & meaning download, or print all the forms, instructions, and publications you may need. Or, you can go to IRS.gov/OrderForms to place an order. Go to IRS.gov/Coronavirus for links to information on the impact of the coronavirus, as well as tax relief available for individuals and families, small and large businesses, and tax-exempt organizations.

For 2022, you received one credit, up to a maximum of four credits, for each $1,510 ($1,640 for 2023) of income subject to social security taxes. Therefore, for 2022, if you had income (self-employment and wages) of $6,040 that was subject to social security taxes, you receive four credits ($6,040 ÷ $1,510). You must pay it as you earn or receive income during the year.

Accounting for Sales Return: Journal Entries and Example

You can either credit them to a separate discount account or deduct them from total purchases for the year. If you want to change your method of figuring inventory cost, you must file Form 3115. For more information, see Change in Accounting Method in chapter 2. Determine the relationship, for this rule, as of the end of the tax year for which the expense or interest would otherwise be deductible. If a deduction is not allowed under this rule, the rule will continue to apply even if your relationship with the person ends before the expense or interest is includible in the gross income of that person. Most individuals and many sole proprietors with no inventory use the cash method because they find it easier to keep cash method records.

Also, you cannot deduct a loss from the disposition of property held for personal use. If you must account for an inventory, you must generally use an accrual method of accounting for your purchases and sales. You will also need to provide your date of birth (DOB). Make sure your DOB is accurate and matches the information on record with the SSA before you e-file. To do this, check your annual Social Security Statement.

What are sales returns?

You can deduct the costs of operating and maintaining your vehicle when traveling away from home on business. You can deduct actual expenses or the standard mileage rate (discussed earlier under Car and Truck Expenses), as well as business-related tolls and parking. If you rent a car while away from home on business, you can deduct only the business-use portion of the expenses.

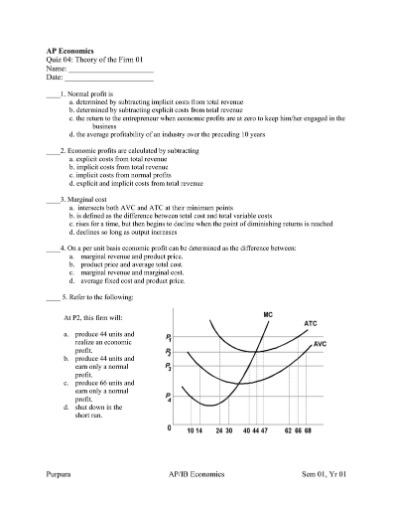

Use Form 8594, Asset Acquisition Statement Under Section 1060, to provide this information. The buyer and seller should each attach Form 8594 to their federal income tax return for the year in which the sale occurred. You choose an accounting method for your business when you file your first income tax return that includes a Schedule C for the business. After that, if you want to change your accounting method, you must generally get IRS approval. There are two approaches for making journal entries of transactions involving sales returns and allowances. A company may choose any approach depending on its volume of returns and allowances transactions during the year.

One more thing … Inventory

With this, there is no point in tracking sales returns and allowances separately. A sales allowance is similar to a sales return in one aspect. However, companies offer sales allowances before the customer pays for them.

- 555 for more information about community property laws.

- Your deduction is the smaller of the following amounts.

- As with a sales return, there could be many reasons for why a customer is given a sales allowance, such as the product being defective, the customer changing their mind, or the product being damaged.

- This means that one must debit sales returns and allowances account to reflect the decrease in revenue.

You can generally deduct the cost of fringe benefits you provide on your Schedule C in whatever category the cost falls. For example, if you allow an employee to use a car or other property you lease, deduct the cost of the lease as a rent or lease expense. If you own the property, include your deduction for its cost or other basis as a section 179 deduction or a depreciation deduction. 16,000 miles were for delivering flowers to customers and 4,000 miles were for personal use (including commuting miles).

Business Expenses

Companies may offer sales allowances for various reasons, which include the following. On Feb 5, journal entry to update the inventory account. See the entries below on how to record the goods returned by customers into the inventories and how it is affected the cost of goods sold. You can use Schedule LEP (Form 1040), Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. SCORE provides small business counseling and training to current and prospective small business owners. SCORE is made up of current and former business people who offer their expertise and knowledge to help people start, manage, and expand a small business.

If you do not have an applicable financial statement, you may use the de minimis safe harbor to deduct amounts paid for tangible property up to $2,500 per item or invoice. You are an attorney and use a den in your home to write legal briefs and prepare clients’ tax returns. The den is not used exclusively in your profession, so you cannot claim a business deduction for its use. You can generally deduct the amount you reimburse your employees for travel and meal expenses. The reimbursement you deduct and the manner in which you deduct it depend in part on whether you reimburse the expenses under an accountable plan or a nonaccountable plan. That chapter explains accountable and nonaccountable plans and tells you whether to report the reimbursement on your employee’s Form W-2.

Thursday’s analyst upgrades and downgrades – The Globe and Mail

Thursday’s analyst upgrades and downgrades.

Posted: Thu, 31 Aug 2023 11:01:24 GMT [source]

Generally, if you produce, purchase, or sell merchandise in your business, you must keep an inventory and use an accrual method for purchases and sales of merchandise. Generally, you report an advance payment as income in the year you receive the payment. However, if you receive an advance payment, you can elect to postpone including the advance payment in income until the next tax year. You cannot postpone including any payment beyond that tax year. If you include a reasonably estimated amount in gross income, and later determine the exact amount is different, take the difference into account in the tax year in which you make the determination.

Deja una respuesta